Is Having a Money Mindset Charitable?

I was talking with a dear friend and asked what she thought of our Enterprise for Kids blog. She thought that it was very well done and that her kids were very inspired by our kids’ enterprise experiences. Her children had read every blog post and watched every video, then her nine year old daughter sat down and planned an enterprise following all the lessons we talk about in our blog.

Wow!

That is exactly the sort of inspiration we hope to develop, especially with kids.

What happened next was a real surprise to me!

My friend explained that she didn’t mind the idea of enterprise, but she wasn’t OK with her kids having an enterprise where they make money for themselves.

I was a little taken back when my friend said this. I really had never thought that there would be people with the view that kids shouldn’t be making money for self interest. I was also grateful that my friend was frank in sharing her beliefs as it helps me better understand mine.

Firstly there is no right or wrong in what people believe or do. Everyone is entitled to their views and I respect my friend’s view.

After this enlightening conversation, I came to realize how far our mindset around money has changed since we started out on our journey in search for economic and personal freedom. It also had me thinking about the entrepreneur’s conscience!

Wealthy entrepreneurs think very differently to the rest of us.

Wealthy entrepreneurs think very differently to the rest of us.

Generally I would also say that they are not selfish; although I’m sure there are some who are, like there are selfish poor people as well!

Wealthy people would have persisted with their goals and taken certain risks to get to where they are now. Many of the wealthiest entrepreneurial people in the world are also very charitable and give millions away supporting causes they believe in. It is much easier to be charitable when you are rich! Many who are struggling to make ends meet do not have the time, energy or money to make larger contributions to the world.

Bill Gates, for example, employs many people to spend his money on charitable causes! Warren Buffett, who has lived in a very modest house all his life, gives away billions to charity! And Sir John Templeton (1912 – 2008) contributes $70 million each year through his foundation providing research grants and programs relating to the Big Questions of human purpose and ultimate reality (very interesting if you have the time to delve!).

Only last week I was speaking with a new entrepreneur friend who lives in Perth. He has recently created tremendous wealth developing property mostly in the Western Australian mining town, Port Hedland. He explained to me that he no longer needs to work and he now channels his energy into his passion. He is planning to take his young family to America where he has enrolled in a Theology university course. From there he plans to do mission work in Africa. Being a successful entrepreneur is allowing him to follow his charitable dream!

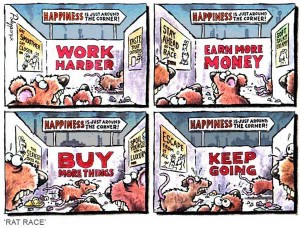

It could be argued that entrepreneurs, as opposed to the rest of us “workers”, have more free time, are less stressed, enjoy better health, eat better, travel more and their families are given more opportunities in life.

It could be argued that entrepreneurs, as opposed to the rest of us “workers”, have more free time, are less stressed, enjoy better health, eat better, travel more and their families are given more opportunities in life.

Do the rich have an entrepreneur’s conscience?

Probably more so than the rest of us!

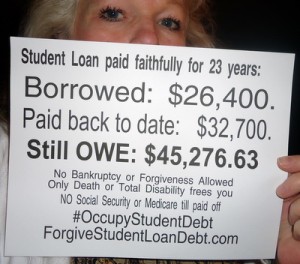

The difference being is that they are in a much better position to make a real difference in our world than those of us who are tied to a “job” and to “debt”.

I’d like to thank my friend who allowed me to consider my views of an “entrepreneur’s conscience”. I certainly value the importance of teaching kids enterprise, and I do support the view that enterprising kids should also be taught to be charitable.

Our view also is that a child has to walk before they can run…..meaning that for us, it’s OK for our kids to have a “selfish” goal because that is what motivates them at the time to take action and learn the entrepreneurial skills necessary to succeed. Then, when they have mastered that skill, they are taught to have a goal, but think about where they may like some of the money they earn to go. That is exactly the process we taught our Chayse (who’s 4) and Kit (who’s now 7) when they reset their goals. See this in action in an upcoming blog.

The more entrepreneurs we create the better our world will be!

As we revisit our own kids entrepreneurial journeys in this blog, we will share the lessons around their entrepreneur’s consciences and how we are teaching them to be charitable.

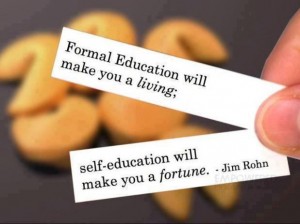

Next time we will talk a little more about the conditioning we have around money and how the wealthy do think differently.

Keep this discussion going by sharing your view in the comment box below.

Lastly, I’d like to take this opportunity to remind you about the Gold and Silver Seminar that we are holding in Bunbury this Sunday. It will be an informative presentation that will open your eyes to some excellent investment opportunities. The discussion after the seminar is a great way to meet and network with other investors and business people. Bring along your teens to kick start their financial education. Click Here to view our flyer and please pass it around to others who you think may be interested.

Lastly, I’d like to take this opportunity to remind you about the Gold and Silver Seminar that we are holding in Bunbury this Sunday. It will be an informative presentation that will open your eyes to some excellent investment opportunities. The discussion after the seminar is a great way to meet and network with other investors and business people. Bring along your teens to kick start their financial education. Click Here to view our flyer and please pass it around to others who you think may be interested.