If you don’t teach your kids about money, then there are plenty of people out there who will! And not all of them will teach your children what they really need to know.

Our kids are educated financially from many sources whether we like it or not. Everywhere they go and everything they look at is conditioning our kids around money.

Teenage kids, for example, are very influenced by their peers, TV and social media. They are pressured to want to have all the latest and greatest of everything! AND…they have to have it now! If you have a teenager in your house (or even a preteen!), you will understand this very well. They will tell you that they are the “only” ones in the “whole world” who doesn’t have one! And if you try to compromise with a cheaper version from Target,… well, forget it! Brand name or nothing!

Many parents fall into the trap of giving into their kids’ persistent demands. We have…..more times than we should have!… and the older a kid gets, the better they are at arguing their point. Some parents may lend their child the money with the view of having them pay it back when they can afford it, or some simply pay for the item fully and don’t expect their child to pay anything back.

But what is this teaching children?

Our son Flynn was preparing to go on a camp with his school. He claimed that ALL the kids would have iPods and that he wanted to buy one to take on camp.

He counted up his money and found that he was short about $100. He was very persistent in his request and we decided to sit down and have a conversation with him around the value of money.

Our dilemma was this – If we were to say an outright “NO, we can’t afford it” then we would be conditioning him with a mindset around “lack of money.”

If we said “YES”, then we would be conditioning him with the mindset to “borrow, then spend!”….and probably not appreciate it too much.

So……………we came up with a solution we had been taught in our mentoring course.

We said “YES”. He could buy an Ipod……however, we weren’t able to pay for it. We brainstormed ideas with Flynn on how he could raise $100. Time was of the essence as he was going on camp in three days.

We came up with ideas such as increasing the marketing of his honey that he was selling through his Honey Enterprise; sell some of his unwanted things such as his surf board; or do a deal with his sister and buy the items she had lined up to sell as part of her “New from Old” enterprise and then resell them with mark up.

The discussion gave him motivation, and we took the punt that if he was really keen for the iPod, then he would make it happen.

The point of all this is that we didn’t automatically say “No, we can’t afford it”…… and we didn’t say “Yes, and we will pay for it”. Rather, we put the onus on Flynn to work out a way to achieve his goal without getting himself into debt. We used this opportunity to teach Flynn about money.

Our Money Mindset Mentor, Paul Counsel, says that in our society, kids are conditioned to “earn, spend and borrow” from a very early age. This conditioning carries through to adulthood and ties people to a job. They need this job to pay for the interest payments on their “things”.

It is hard for our kids to avoid this type of conditioning. Their sporting idols appear on TV advertisements telling them what a great investment they are making if they buy x,y or z……and finish with a trusting wink!

Celebrities promote all sorts of things from insurance and jewellery to holidays. Retailers offer low cost, easy monthly payments for expensive items that people really can’t afford. There goes the “earn, spend and borrow” cycle again. Even airlines offer credit these days!

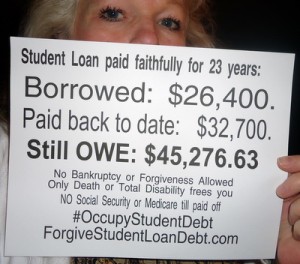

The education faculties don’t teach your kids about money either. In fact they will also put young people into tremendous debt by financing their higher education courses. Young people who spent five years working hard for a qualification, come out at the end with a massive debt!

Here is a hard fact… this year the total amount of student loan debt in the US hit the $1 trillion mark. Back in 2010, the amount of U.S. student loan debt surpassed the total amount of credit card debt, and it continues to grow. The trend in Australia is following that of the US.

We can look at life as being a game full of experiences! We are here on earth to play the game. Yet from an early age the odds are stacked against us to achieve personal and financial freedom when we are “conditioned” to earn, spend and borrow for unproductive things.

And who is the best person to teach this change to your children?

Well, if you have already achieved financial and personal freedom, then the best teacher is YOU!

And if you haven’t, then find someone who has achieved the type of financial or personal success you would like for your kids. You may even learn something in the process. 🙂

Loved reading the case history

Yes, pretty interesting stuff. Sad, but true.

Great advice!

The proof will be in the pudding years from now for our kids 🙂

it is important to know how to save as well as how to spend money. i wish i had your sort of instruction in my teen years! Roma

Hi Roma,

Saving money is a hard task for some kids in today’s society of “see it now, want it now” instant gratification. That’s the great thing about having long and short term goals. It keeps the kids focused on what they want to achieve.

Good lessons for us as parents too 🙂

Cath and Trev