In the last blog we spoke about “who it is that teaches our kids about money”. We’d like to delve a little deeper with this topic in this blog. Our intention is to build an understanding of why most of us have settled into the role of being a “worker” rather than following the “entrepreneurial” path. You will also learn a little more about what we are endeavoring to achieve as a family.

Our kids, like all kids, want to have their own money so that they can have a little independence and buy the things that they want. In our family our children sometimes receive money when it is their birthday and they also get a little pocket money.

Kaitlin, our eldest, has a part time job working at a local Brewery serving lunches and doing the kitchen work. She works hard and it pays pretty well. However, to take on a job, she loses some of her weekends and time to do her school work and have a social life. She also commits time to regular baby sitting work for some of the families in the area.

At present the money mindset of my children is much the same as ours, which is likely to be the same as most other people, and that is to earn money, spend and borrow money!

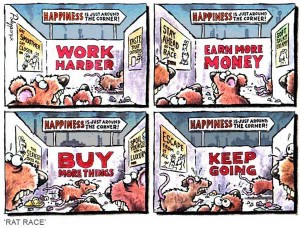

Generally most of us either have a job where we give time for a salary or we have a business where we give our time for a monetary return. Whatever the case, we are tied down and limited with what money we earn and we sacrifice our time for it. Sound familiar?

The funny thing is, that right from an early age we are conditioned to accept this to be the norm and often our minds are generally closed off to entrepreneurial ideas and opportunities. Our schools train us and prepare us for the workforce. Our parents will do the same by pointing us towards a vocation.

Adding to this, media advertising, TV, politicians, universities and our peers all guide us towards getting a job. It is all around us, well intentioned people and institutions all keeping us on the “straight and narrow” pathway of getting a job (earn!), then spending our money on things (spend!) and then borrowing money to spend on more things (borrow!).

Look at the people around you and you will see this pattern repeated everywhere. People with expensive things like houses, TVs, holidays, cars, boats and caravans. Most are servicing mortgages to pay for it all. The more things they acquire during their lives the harder and longer they have to work to pay for the things. Most people can see no way out of their situation and accept that this is what is supposed to happen. The average Australian spends about $1.15 out of every dollar they earn!

In fact most of us have been conditioned to accept this money mindset which locks us into the“Rat Race!”

Now you may challenge us by saying, what’s wrong with our kids entering the workforce, what’s wrong with spending what they earn and borrowing some more! Honestly, there is nothing wrong or right about it at all. It is just what it is.

For us though, we’re looking for a new direction where we have the time to follow our passions and to be able to give freely to our family, community and world without worrying how to pay for it. Our goal is to break out of the “worker” mindset.

We seek to know how the relatively few, “financially and time free” people managed to rise above the Rat Race. We want to know what they do that is different. How do they think and what is their conditioning around money mindset!

What’s more, we wish for our kids to grow up with the mindset of an entrepreneur! It is important to us that they get a “financial education”.

From what we’ve discovered so far, is that kids need to start very early to develop their entrepreneur mindset and the skills needed to manage money and build enterprise. They need role models who can foster a different thinking and parents who encourage and look for opportunities that foster enterprise. Open discussions about money and business will help to develop a financial education for kids.

We desire for our seven children to grow up having choices. We want their pathways to be wide with opportunity! We encourage them to follow their passion and not be conditioned into the “earn, spend and borrow” mindset. We hope that they will think differently, have belief in themselves and develop the habits of people who have achieved personal and financial freedom.

We know we have a challenge ahead of us, as our kids have already been conditioned from an early age. Using Kaitlin as an example; she earns money, spends freely and already has a debt. She is studying hard to go to university with all her friends and then ultimately to get a good paying job. Once again I’ll point out that there is no right or wrong about this, only that we would like her to see that there are other ways.

It is always going to be a challenge whilst we have that same conditioning and mindset. Although striving to change our thinking, we recognise that it will take time and persistence to learn new habits and shift old belief systems. However, we are very confident that this year, is the year that we will have a break through. We have enlisted the help of a Money Mindset personal mentor, who is helping us develop a new thinking. He is there to help us transform in our thinking through our actions…. and as we do so, so will our children.

With our up coming blogs we will share his education with you.