“Failing to plan is planning to fail!” Robert Kiyosaki

Most people have a plan on how to make their money, but they do not have a plan on what to do with their money when they make it. Kiyosaki points out that often these are the same people who will have a problem with not having enough money.

He also explains that if you have a good plan before you earn it, then your problem will be having too much money! …Now I like that problem!

He also explains that if you have a good plan before you earn it, then your problem will be having too much money! …Now I like that problem!

Kids need an education on how to plan what to do with their money when they earn it.

Kiyosaki goes on to say,

“Poor people don’t have a plan. All they do is earn more money and spend it on bigger liabilities that take more money from their pockets and then they have to earn even more money. Therefore, despite what they earn, they are always short of money.”

The solution is to plan to spend earned money on Assets (things that appreciate over time) to make passive income. Don’t buy liabilities (things that depreciate and lose money over time) with earned income. Then use some of your passive income from the assets you own to buy the liabilities you want.

Our own kids are all busy planning their enterprises and are successfully making themselves money. They have plans to buy liabilities such as nerf guns, Ipods, computers and so forth, but no plan to buy assets. So I thought it was time to have a conversation with my kids about having a plan to buy assets.

We wrote an article about our conversations with the kids about Assets and Liabilities. Here is a link to that article.

Once “Assets” as opposed to “Liabilities” was explained to the kids they were then able to make a plan to buy assets. In the above mentioned article I gave several suggestions of Assets that kids could buy. I would like to elaborate further on why Gold and Silver is an excellent asset that our kids could buy with their earned money.

Subscribers to this blog would have seen the promotion of a Gold and Silver Seminar that we hosted here in Bunbury a few weeks back. Our presenter, Andrew Smith, a mining engineer, investor and businessman, has been intimately involved with the world of Gold and Silver mining for many years. He gave many excellent reasons why Gold and Silver is well worth considering as a long term asset investment. I’ll now explain some of those reasons.

Gold and Silver is recognised world wide as money and can be used to buy products and services just as fiat currencies can. The first gold coin was around in 600BC in Lydia, Asia. The difference being, currencies devalue whilst gold and silver hold their value.

Andrew invented the “Meat Pie Indicator” to show why this is!

Let’s see if you can get your head around this explanation of how the Meat Pie Indicator works!!

Back in 1970 you could buy a meat pie for 40c and today the same pie would cost you $4.50. Andrew explains that this indicator shows the Aussie dollar devaluing 350% over a period of 42 years (ie you need 350% more cash to buy the same pie).

What is interesting, is that if you had bought the meat pie with 40c worth of silver back in 1970 when silver was less than $2 an ounce, you would have needed one fifth of an ounce. Yet if you bought the same meat pie today using silver (at $35 an ounce) you would only require about one eighth of an ounce of silver. Silver has increased in value by more than 400% during the same period!

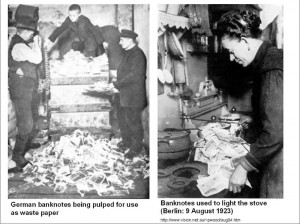

This is a terrific example of the Dollar devaluing due to inflation, whilst Silver (& Gold) gains in value! And no it isn’t just the Aussie Dollar that has devalued! All world currencies have! What’s worse, is that hyperinflation in certain countries have caused their currency to become absolutely worthless. Take Zimbabwe for example. Interestingly though, the people of Zimbabwe are now using gold to buy and sell goods.

If you are interested in understanding more about Hyperinflation and how it could even happen to us down under, then have a look at these videos…

Hyperinflation Nation Part 1

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man” Ronald Reagan 1980

As you can see, having precious metals is a hedge against inflation and devaluing currencies. Although this in its self is a very good reason to own gold and silver, there are also many more reasons.

Reserve Banks around the world are injecting more and more money into their economies. This money is being created out of thin air! Every time this occurs it dilutes the money supply and makes it more expensive to buy goods and services. It creates inflation, which in turn reduces the buying power of the dollar. What also happens is that more money is needed to buy gold and silver!

It is estimated that there is 80,000 tons of gold in the ground (in the World) and we currently mine 2500 tons a year. At the current rate of mining there is less than 30 years of gold left in the ground. Silver is running out even faster with only 20 years of silver mining remaining. I guess you can see that with gold and silver running out and the ever growing world requiring more and more of it, then you would expect their values to increase.

What’s more, the Indians and Chinese love buying gold and silver, and as they become wealthier, so will their thirst for these metals. There are 2.6 billion Chinese and Indians. Much of the gold is bought as jewellery during the Hindu wedding season and during the Chinese New Year celebrations. It is estimated that there is 18,000 tons of gold jewellery present in India alone today. That is a huge amount considering that 165,000 tons have been mined world wide to date!

The commercial demand for silver in manufacturing products such as mobile phones, solar panels and mirrors means that the silver used with producing such products is not stored, but used up. This demand has been increasing year by year.

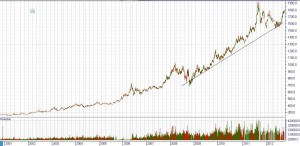

Since 2001 the USD gold price has increased by 500%.

As you can see fundamentally owning gold and silver for the longer term looks to be very promising. So why not introduce your kids to buying this asset class with some of their earned money, or rather than giving them cash for birthday presents, give them silver!

It is very easy to do. The Perth Mint buys and sells gold, silver and platinum. All you need to do is walk in and buy it. Gold at $1750/ounce may be out of their league, but silver at $34/ounce is manageable. They can buy coins or bullion. Bullion will be better value for money, as coins are looked upon as collectables and have an additional cost for minting which greatly inflates the cost to buy the silver.

Our kids now have new goals. There goals are broken up into three parts and they have a plan for each. A part for buying liabilities, a part for buying assets and a part for tithing!

This website is worth a look at if you are keen to further your education on Gold and Silver.

Cathy and I and a group of our friends are very excited to be heading up to Perth to learn from another Great Master. His name is David Wood and his event will be awesome! So I guess our next blog article will be about what we learn from him!