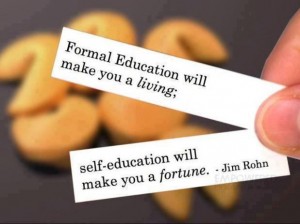

Robert Kiyosaki, famously known for his book “Rich Dad Poor Dad” points out that kids need to be given a financial education and that they are unlikely to get a financial education from school!

Kiyosaki emphasises that by teaching kids to understand balance sheets, you are giving them the basis of a financial education. Balance sheets have two columns, Assets and Liabilities. Kids need to know the difference between Assets and Liabilities.

Kiyosaki emphasises that by teaching kids to understand balance sheets, you are giving them the basis of a financial education. Balance sheets have two columns, Assets and Liabilities. Kids need to know the difference between Assets and Liabilities.

Kiyosaki’s simple definition of an asset is something that puts cash into your pocket and a liability is something that takes cash out of your pocket! Examples of assets are stocks, investment property, bonds, gold, businesses and valuable antiques. Examples of liabilities are cars, boats, houses, clothes, holidays, TVs and if you are a kid, toys.

Rich people start out by taking the money they earn from salary to buy assets. These assets put cash into their pockets. They take some of that cash to then buy liabilities. They also use some of the cash to buy more assets. Eventually their assets provide enough cash flow that they no longer need a “job”.

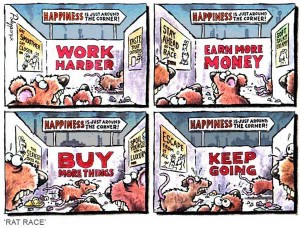

On the other hand, the poor and middle-class earn a salary, which they spend on liabilities with little or nothing left over to buy assets. As they go through life they buy more and more liabilities and have to work harder to earn more money to pay for them. Many will borrow money to buy more things.

On the other hand, the poor and middle-class earn a salary, which they spend on liabilities with little or nothing left over to buy assets. As they go through life they buy more and more liabilities and have to work harder to earn more money to pay for them. Many will borrow money to buy more things.

When kids understand a balance sheet, they can then be encouraged to develop the habit of putting some of the money they get into buying assets before spending it all on liabilities. This habit will be the basis to them creating wealth as they grow up.

I had a good conversation with Flynn a while back. He has made a large sum of money from his Honey Enterprise and has already spent some of it on his goal, which was to buy an iPod.

Flynn has some mates who are mad keen on riding motorbikes and Flynn now has his sights set on buying one.

I explained that he could buy one, but first he must understand that a motorbike is a liability and will take money from his pocket (devalue, repairs, fuel, safety equipment etc). I then explained what Robert Kiyosaki teaches about balance sheets. Flynn took what I explained on board and as a result of our chat he now keeps three jars of money. One for gifting, one for his liability (the motorbike) and one for buying assets!

So what assets can a kid buy?

Well cash could be considered an asset (however, over time currencies generally devalue, so maybe it isn’t a true asset unless it is gaining a good interest from the bank!). Kids can buy collectables or small amounts of gold and silver. With their parents help they could also buy shares in companies, or put their cash into building their enterprise… as in Flynn’s case, more wholesale honey or even a bee hive of his own!

Flynn decided that he wants to buy silver. Currently its market value is about $30 an ounce and can be bought from the Perth Mint. Five years ago silver was only $9 an ounce. That’s a pretty good gain considering that the GFC was during this time! In fact, at one stage silver reached as high as $47 early last year!

Flynn is getting a Financial Education.

This conversation about silver is very relevant to my next guest I am about to introduce to you. Andrew Smith is an expert in Silver and Gold. He is a qualified mining engineer, who is involved with a company (www.orica-miningchemicals.com) selling chemicals to gold mines. He has been involved with Gold and Silver mining for many years and has an in depth knowledge of the fundamentals of gold and silver and investing in these precious metals. If you are interested in capitalizing on the precious metals’ opportunities and seeing Andrew present live in Bunbury, WA, click this link.